iedge s reit

Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source. Tune in to Growth Track Podcast.

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

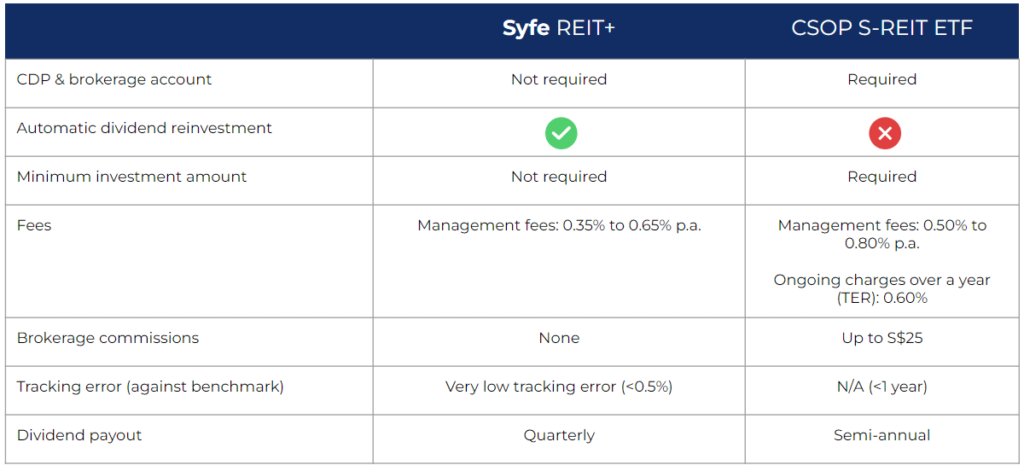

The CSOP iEdge S-REIT Leaders Index ETF has a management fee of 05 and a total expense ratio of 06 which is capped and would be deducted annually as fees.

. Bloomberg 14 October 2011 15 October 2021. What I dont like about this is theres no track record for this ETF. If we assume dividends are not reinvested the returns would have been 431.

Bloomberg CSOP 6 May 2016. The index is one of Singapores most popular REIT indices. CSOP iEdge S-REIT Leaders Index ETF projects its 2022 dividend yield to be 53.

SRU on 18 November 2021 and the initial offering period has already started on 29 October 2021. Growth Track is SGX Groups podcast series where we focus on investment and growth opportunities across Asia. Since 2017 investors have had a choice between three REIT ETFs on the Singapore Exchange SGX.

The iEdge S-REIT Leaders Index ETF is a diversified and return-focused ETF that provides investors with exposure to some of the most important uprising industries in real estate in different geographical locations with Singapore being the. Online subscription for the ETF is now open during the Initial Offer Period IOP online from 29 October 2021 till 15 November 2021 by 930am. Bloomberg CSOP 6 May.

The CSOP iEdge S-REIT Leaders Index ETF is available in two main currencies SGD and USD. SGX as of 30 June 2021 6 Source. As of 19 Jun 2022 NAV - 09364 Expense Ratio - Nil.

Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source. View live IEDGE S-REIT INDEX chart to track latest price changes. SGX as of 30 June 2021 6 Source.

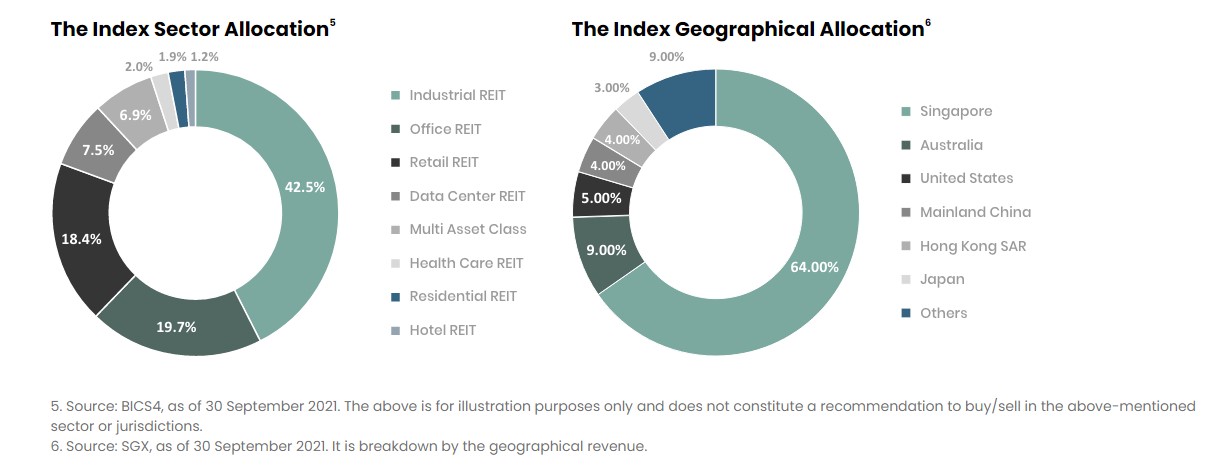

It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. SGX as of 30 September 2021 5 Source. SGX as of 30 September 2021 5 Source.

Constituents must be listed on SGX and classified under Reits as defined by the Factset Revere Business Industry Classification System. Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX. Liquid Real Estate Exposure.

Investors holding a REIT can enjoy. If youre looking to build a diversified REIT portfolio the iEdge S-REIT Leaders Index is one option to consider. Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance.

Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC. After paying its expense ratio of 06 thats about 47. That is set to change with a fourth option entering the fray.

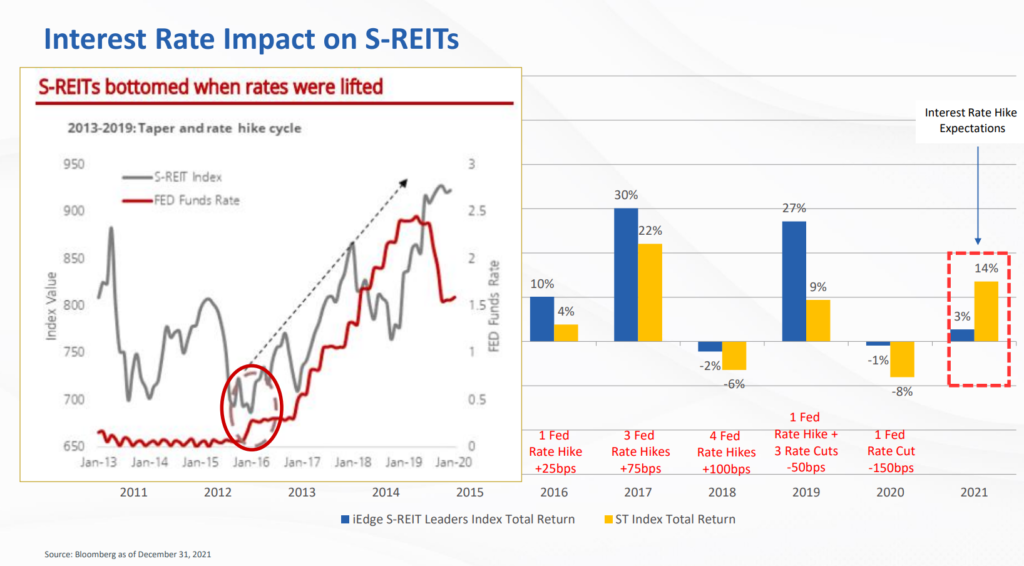

Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. The iEdge S-Reit Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid trusts in Singapore. It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396.

Refers to dividend yield of iEdge S-REIT Leaders Index. The index measures the performance of the most liquid REIT in Singapore. Invest in Singapores best REIT with one portfolio Index by iEdge S-REIT Leaders Learn more Attractive dividend yield Optional risk management Annual fee 035 to 065 As your investment grows Risk Rating 4 High Risk You can trust Syfe to grow your wealth Regulated by Monetary Authority of Singapore Licence - CMS100837 Platform partners.

IEdge S-REIT Leaders Index USD - Singapore Exchange SGX Loading. A real estate investment trust in Singapore S-REIT A fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund. The latest 12-month dividend yield is at 408 as of 31 October 2021.

In terms of sustainability of its yield from my understanding the iedge s-reit leaders index is projected to deliver a growth of 593 and a yield of 543 in 2022 according to bloomberg terminal as at 30 september 2021 and highlighted in rectangular boxes below and as the csop iedge s-reit leaders etf tracks the performance of this index. It tracks the largest and most liquid REITs in Singapore including household names like Ascendas REIT Mapletree Commercial Trust and CapitaLand Integrated Commercial Trust. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet.

SGXREIT trade ideas forecasts and market news are at your disposal as well. SGX as of 30 September 2021. Bloomberg SGX as end of 2020 2 Source.

To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy. SINGAPORE November 11 2021--CSOP Asset Management will list its second Exchange-Traded Fund ETF on SGX - CSOP iEdge S-REIT Leaders Index ETF Stock Code. Singapore REITs A Reopening Story.

Not too bad for buying a diversified REIT ETF. CSOP iEdge S-REIT Leaders Index ETF factsheet Which means this Singapore REIT ETF projects to pay a higher dividend yield of 53. CSOP Asset Management a Chinese asset manager based in Hong Kong has announced that it will list the CSOP iEdge S-REIT Leaders Index ETF on the SGX this month under the symbol SRT.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. With the soon to be listed CSOP iEdge S-REIT Leaders Index ETF investors will now be able to invest in S-REITs via an ETF to reap its diversification benefits. Advised by JLP Asset Management Asia Pte.

Was the only S-Reit which received both net institutional and retail inflows for Q1 2022.

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf Poems

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

南方东英iedge新加坡房地产投资信托领先指数etf将在新交所上市 Business Wire

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Singapore Reit Etfs Guide Comprehensive

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

Syfe Reit 100 000 Portfolio Review And 3 Things You Probably Didn T Know About It Turtle Investor

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

0 Response to "iedge s reit"

Post a Comment